osceola county property tax due date

Tangible Personal Property Returns Due. The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property.

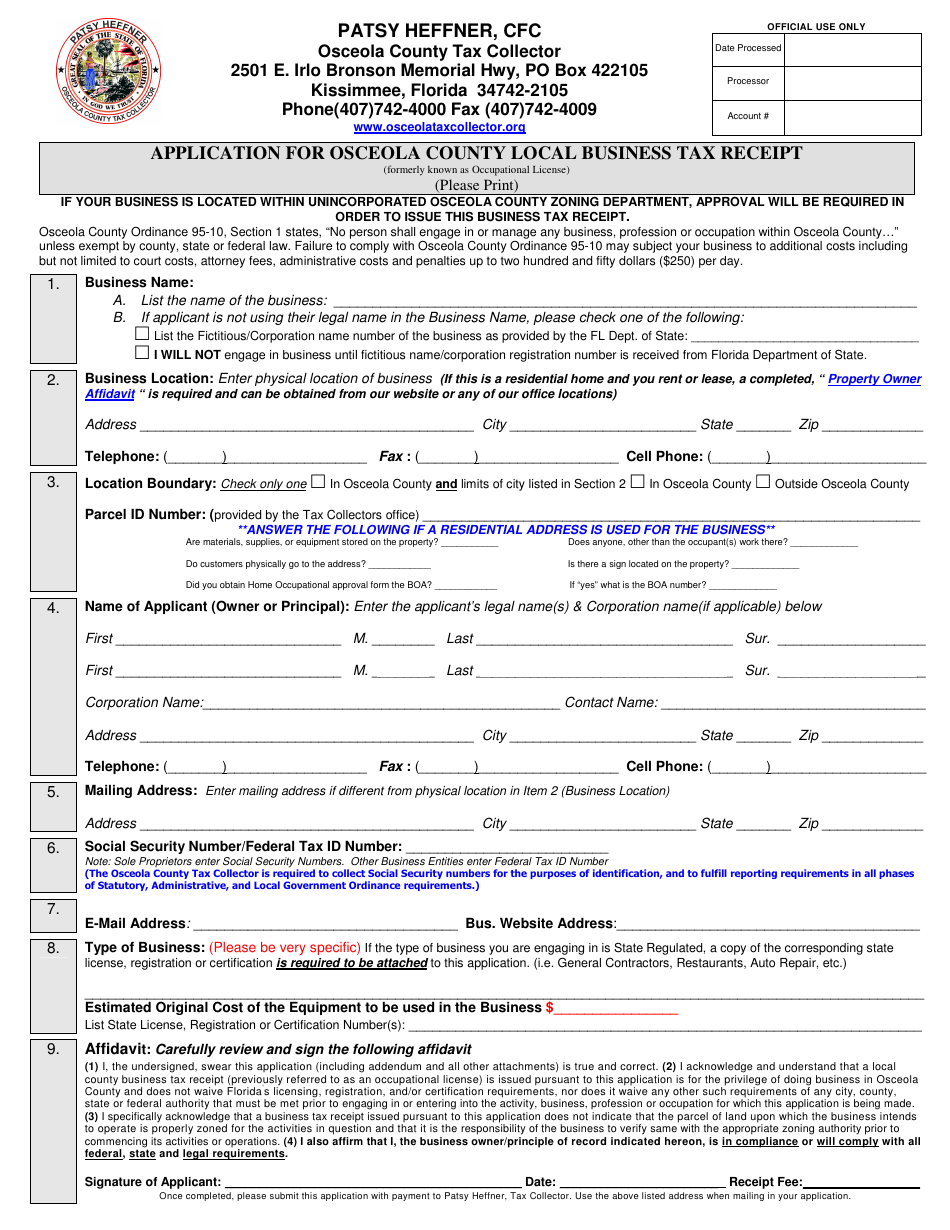

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property.

. Osceola County collects on average 095 of a propertys. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. If you dont pay by the due date you will be charged a penalty and interest.

Perhaps youre unaware that a property tax bill may be bigger than it ought to be due to a distorted evaluation. Be equal and uniform 2 be based on up-to-date. Deadline to File for Exemptions.

Assessment Valuation End Date. Osceola county tax collector notice of ad valorem and non-ad valorem assessments must be paid in us. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get.

Irlo Bronson Memorial Hwy. Local Business Tax Receipt. You can call the Osceola County Tax Assessors Office for assistance at 407-742-5000.

No worries should you feel overwhelmed. If you turn up what appears to be an overstatement of tax due you need to counter swiftly. IMPORTANT DATES OSCEOLA COUNTY TAX COLLECTOR Office of Bruce Vickers CFC.

The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of. The Tax Collectors Office provides the following services. Search all services we offer.

Banks no post dated checks bruce vickers tax colelctor po box. Property Appraiser Important Dates. Tangible personal property tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental property.

Applications for next years property tax installment payment plan due April 30th. These taxes are due Wednesday September 14 2022 by 500pm. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

14 the total of estimate taxes. What is the due date for paying property taxes in Osceola county. A 1 interest charge is added to the amount due every month after the due date.

Learn all about Osceola County real estate tax. Tonia Hartline 301 W. Property taxes are due on September 1.

Ultimate Osceola Real Property Tax Guide for 2022. Funds through a us. It may make sense to get service of one of the best property tax attorneys in.

Osceola Tax Collector Website. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a.

Campbell City Tax Collector Civic Architect Design The Lunz Group

Osceola County Tax Collector S Office Bruce Vickers Facebook

Property Tax Bills Have Been Mailed Out Polk County Tax Collector

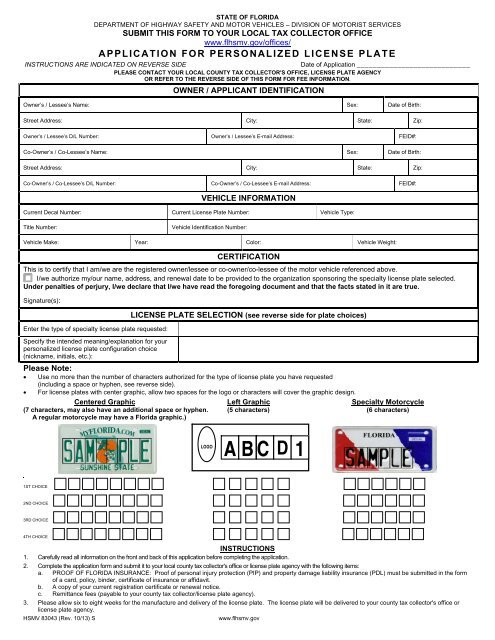

Application For Personalized License Plate Osceola County Tax

St Cloud Chamber Of Commerce Homestead Exemption Press Release Osceola County Property Appraiser Exemptions And Covid 19 Kissimmee Florida February 18 2021 Osceola County Property Appraiser Katrina Scarborough Encourages Osceola County

If You Haven T Paid Your Property Taxes Yet Please Note The Deadline Is March 31st You Can Check To See If Yours Have Been Paid Already Or Make A By Osceola County

What Is Florida County Tangible Personal Property Tax

How To Pay Osceola County Tourist Tax For Vacation Rentals

Positively Osceola News Today Osceola County S Leading And Trusted Source For News By Positively Osceola Issuu

News Briefs Relief For Local Small Businesses And Flood Insurance Customers New Kissimmee Postmaster Osceola News Gazette

Campbell City Tax Collector Civic Architect Design The Lunz Group

Solar Panel Installation In Osceola County Florida

Please Note That If You Pay Your Property Taxes Using The Installment Plan Or Would Like To Applications For Next Year S Property Tax Installment By Osceola County Tax Collector S Office

Osceola County Florida To Issue Stay At Home Order Walt Disney World Property Completely Under Local Orders Through April 9th

If You Haven T Paid Your Property Taxes Yet Please Note The Deadline Is March 31st You Can Check To See If Yours Have Been Paid Already Or Make A By Osceola County

Osceola County Ordinance 00 13 Indian Wells Hoa

75 63 Acres M L Osceola County Gilman Township Stalcup Agricultural Service Inc